now available!

Use Your FSA/HSA to Save Up to 30%

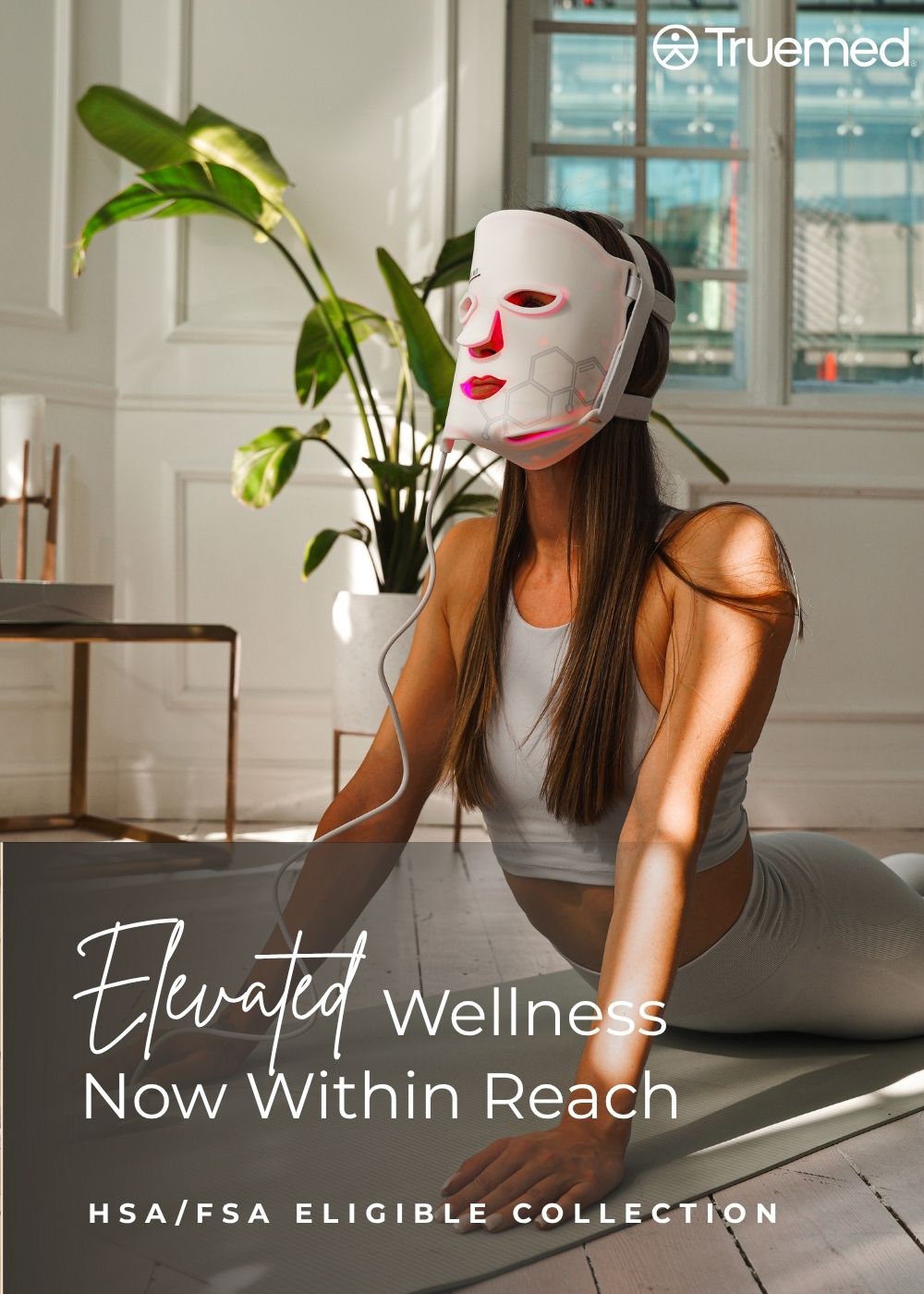

We’ve partnered with Truemed to help you turn your HSA/FSA funds into your personal self-care budget—just in time to prioritize your skin and wellness. Don’t let your benefits go to waste!

Health savings accounts (HSA) and flexible spending accounts (FSA) are programs that allow you to set aside pre-tax dollars for eligible healthcare expenses. If you’re unsure whether or not you have an HSA or FSA account, please check with your employer or insurance company.

For most HSA/FSA administrators, your expenses will be approved within days when you submit it with your Truemed Letter of Medical Necessity. The exact timing will vary based on your administrator.

You can use your HSA/FSA dollars all year long. However, FSA dollars expire at the end of the year and unused money may not rollover into the next year. Make sure to spend the rest of your FSA dollars before December 31st — use it, so you don’t lose it!

Checking Out Is Easy

STEP 1

Add products to your cart

STEP 2

Check out as a guest

(not with Shop Pay)

STEP 3

Select Truemed as your payment option at checkout

STEP 4

Enter your HSA or FSA debit card

STEP 5

Take a quick health survey to determine eligibility

Eligible Products

These are our top performing products that are eligible for HSA/FSA.

Many others are also available to purchase with HSA/FSA. This will be indicated directly on the product pages.

FAQ

When you use the Truemed payment option, your cart is automatically split into eligible and ineligible items. Then you simply apply the appropriate payment method to each subtotal.

No problem—you can submit for partial reimbursement. For example, if you buy a $100 eligible item but only have $60 in your account, that $60 will be reimbursed from pre-tax funds.

Truemed offers a reimbursement guarantee. If your eligible purchase is rejected, Truemed will cover up to 30% of the original purchase amount.

No—there’s no cost to you when shopping with us through a Truemed partner merchant.

An LMN is a document from a licensed provider stating that your purchase addresses a medical need. This satisfies IRS requirements, making your wellness tools eligible for reimbursement—even though they’re not prescription medications.

HSA funds: Roll over year to year, no deadline.

FSA funds: Generally expire at year’s end (12/31), though some plans allow a grace period or limited rollover. Check your plan—and don’t lose your money!